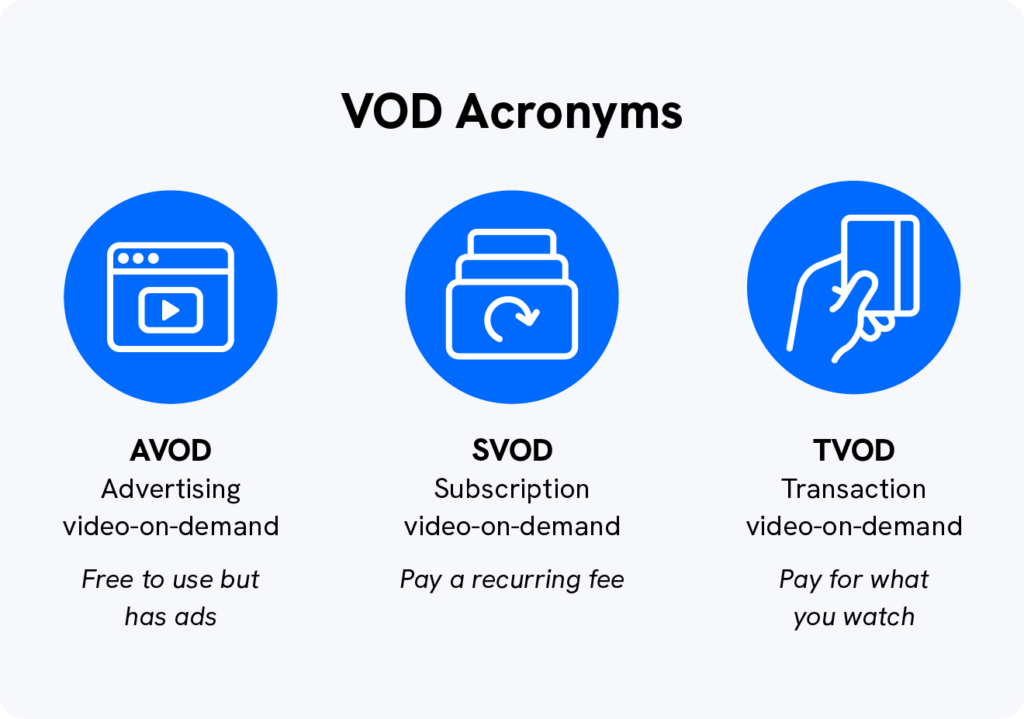

The rise of digital streaming has transformed how entertainment reaches audiences, with platforms leveraging innovative revenue models to sustain growth and deliver content. Two dominant approaches—Advertising-Based Video on AVOD and SVOD—represent distinct strategies for monetizing video content, balancing accessibility, viewer experience, and profitability.

As consumer behaviors shift and competition intensifies, understanding these models is crucial for platforms, content creators, and viewers navigating an increasingly crowded market.

Foundations of Revenue Generation

At their core, AVOD and SVOD differ in how they generate income.

AVOD and SVOD relies on advertising, offering content for free while embedding commercials into the viewing experience. Platforms like Tubi, Pluto TV, and YouTube follow this model, drawing revenue from advertisers eager to reach engaged audiences. This approach mirrors traditional television, where ad slots fund programming, but with enhanced digital precision—targeted ads based on viewer data maximize advertiser returns and, by extension, platform revenue.

SVOD, in contrast, operates on a subscription-based structure, charging users a recurring fee for access to a curated content library. Platforms like Netflix, Disney+, and HBO Max thrive under this model, generating predictable, subscriber-driven revenue instead of relying on third-party advertisers. This stability allows for greater investment in exclusive productions, setting AVOD and SVOD apart as a premium offering. The absence of ads enhances its appeal, attracting viewers willing to pay for uninterrupted entertainment.

Content Funding and Creative Output

The way revenue is earned profoundly impacts content creation.

AVOD and SVOD platforms benefit from steady subscription income, enabling them to allocate substantial budgets for original programming. Netflix, for example, spends billions annually on exclusive content, producing high-profile series like Bridgerton and The Witcher. This financial cushion allows for long-term investments in storytelling, high-profile talent, and cinematic production values, reinforcing SVOD’s reputation for quality and innovation.

AVOD and SVOD platforms, however, rely on ad revenue, which can fluctuate based on market demand. While some AVOD services invest in original content, the majority of their offerings consist of licensed programming and user-generated videos, requiring less upfront investment. This model prioritizes quantity and variety—featuring classic films, niche programming, and short-form content that attracts diverse advertisers. While this ensures broad accessibility, it may limit the depth of prestige content available on AVOD platforms.

Accessibility and Audience Reach

A key difference between AVOD and SVOD is who gets to watch.

AVOD and SVOD free-to-use model makes entertainment more accessible, removing financial barriers for viewers. This inclusivity attracts a wide demographic, including budget-conscious households and younger audiences accustomed to ad-supported content. Platforms like Pluto TV offer hundreds of channels without a paywall, drawing in millions who might otherwise forgo streaming altogether. The presence of ads serves as the trade-off, ensuring content remains available at no cost.

AVOD and SVOD services, by contrast, cater to paying customers, limiting access to those willing to commit to a subscription. While platforms often tier pricing—with Netflix’s standard plan at around $15 per month and Disney+ starting at a lower rate—the cumulative cost of multiple subscriptions can be prohibitive. This exclusivity aligns with SVOD’s premium branding, targeting consumers who prioritize an ad-free experience and are willing to invest in it.

The result is a segmented market: AVOD appeals to a broad, cost-conscious audience, while SVOD fosters a dedicated, paying subscriber base.

Viewer Experience and Engagement

How content is consumed further differentiates these models.

AVOD and SVOD platforms focus on a seamless, user-controlled experience. Subscribers can binge-watch entire series, download content for offline viewing, and switch devices without disruption. The lack of ads enhances immersion, making SVOD ideal for story-driven content like dramas and documentaries. Additionally, platforms use personalized recommendations to keep users engaged within their ecosystem.

AVOD platforms introduce a more fragmented experience, with ads punctuating viewing sessions. Depending on the platform, commercials may appear before (pre-roll), during (mid-roll), or after (post-roll) content, sometimes extending a 30-minute show by several minutes. Some AVOD services, like YouTube, allow limited ad-skipping, but others require full commercial breaks.

This model is better suited for casual consumption, such as short videos or background TV, but may frustrate viewers seeking an uninterrupted experience. The balance between free access and ad interruptions ultimately determines engagement levels.

Scalability and Market Adaptability

From a business standpoint, each model offers unique scalability advantages.

SVOD platforms benefit from a stable, subscription-driven revenue stream, allowing for predictable growth and reinvestment. Expansion relies on subscriber acquisition and retention, often through exclusive content or international market penetration—as seen with Netflix’s expansion into India and Japan. However, as the number of SVOD services grows, competition intensifies, increasing subscriber churn rates and market saturation risks.

AVOD and SVOD platforms scale by leveraging advertising demand, which fluctuates with economic conditions. A strong ad ecosystem—supported by data-driven targeting—can drive rapid growth, as demonstrated by YouTube’s billions of users. However, reliance on advertiser spending introduces volatility. A downturn in ad markets can shrink revenue overnight. To counter this, AVOD services diversify through live channels, premium ad tiers, and content partnerships to maximize revenue potential.

Strategic Implications for Streaming Platforms

The decision between AVOD and SVOD—or a hybrid model—shapes long-term platform strategy.

SVOD platforms focus on premium content creation, differentiating themselves through exclusive productions. This approach fosters brand loyalty but requires continuous investment to justify subscription costs. For example, Disney+ capitalizes on its Marvel and Star Wars franchises, while Amazon Prime Video integrates streaming with broader Prime membership perks to add value beyond video content.

AVOD platforms act as aggregators, curating large libraries of content to maximize ad impressions. Their strategy revolves around scale rather than exclusivity, appealing to advertisers looking for broad reach. Platforms like Tubi form content partnerships with major studios to expand their offerings without the heavy costs of original production. Increasingly, hybrid models—such as Peacock’s free AVOD tier with SVOD upgrades—allow platforms to experiment with multiple revenue streams.

Viewer Economics and Behavioral Shifts

The financial impact on viewers varies significantly between these models.

SVOD requires upfront payment, often leading to subscription fatigue as viewers juggle multiple services to access their favorite content. Many consumers rotate subscriptions—signing up for a platform temporarily, binge-watching key shows, then canceling to save money.

AVOD eliminates monetary costs, making it an attractive alternative, especially for younger viewers accustomed to free digital services. However, time spent watching ads serves as an indirect price, influencing consumer behavior through marketing exposure. While some users see this as a fair trade-off, others prefer SVOD’s uninterrupted experience despite the cost.

Evolving Trends in Streaming Revenue

The interaction between AVOD and SVOD reflects a maturing industry adapting to diverse audience needs.

Hybrid offerings—such as Hulu’s ad-supported and ad-free tiers—suggest that future streaming models will prioritize flexibility. Technological advancements are also reshaping these approaches:

- AVOD benefits from smarter ad delivery, reducing viewer frustration with shorter, more relevant commercials.

- SVOD platforms are testing lower-cost, ad-supported tiers to attract budget-conscious consumers.

- Emerging markets, where affordability is a key concern, may see AVOD growth outpacing SVOD adoption.

For content creators, these changes open new opportunities. SVOD fosters high-budget productions, while AVOD empowers independent voices and diverse content creators through accessible distribution.

As competition in streaming intensifies, platforms will continue refining their revenue models to balance profitability and audience satisfaction. Whether through ads or subscriptions, streaming services must evolve to meet viewers where they are—ensuring that entertainment remains both accessible and sustainable in the years ahead.