Introduction

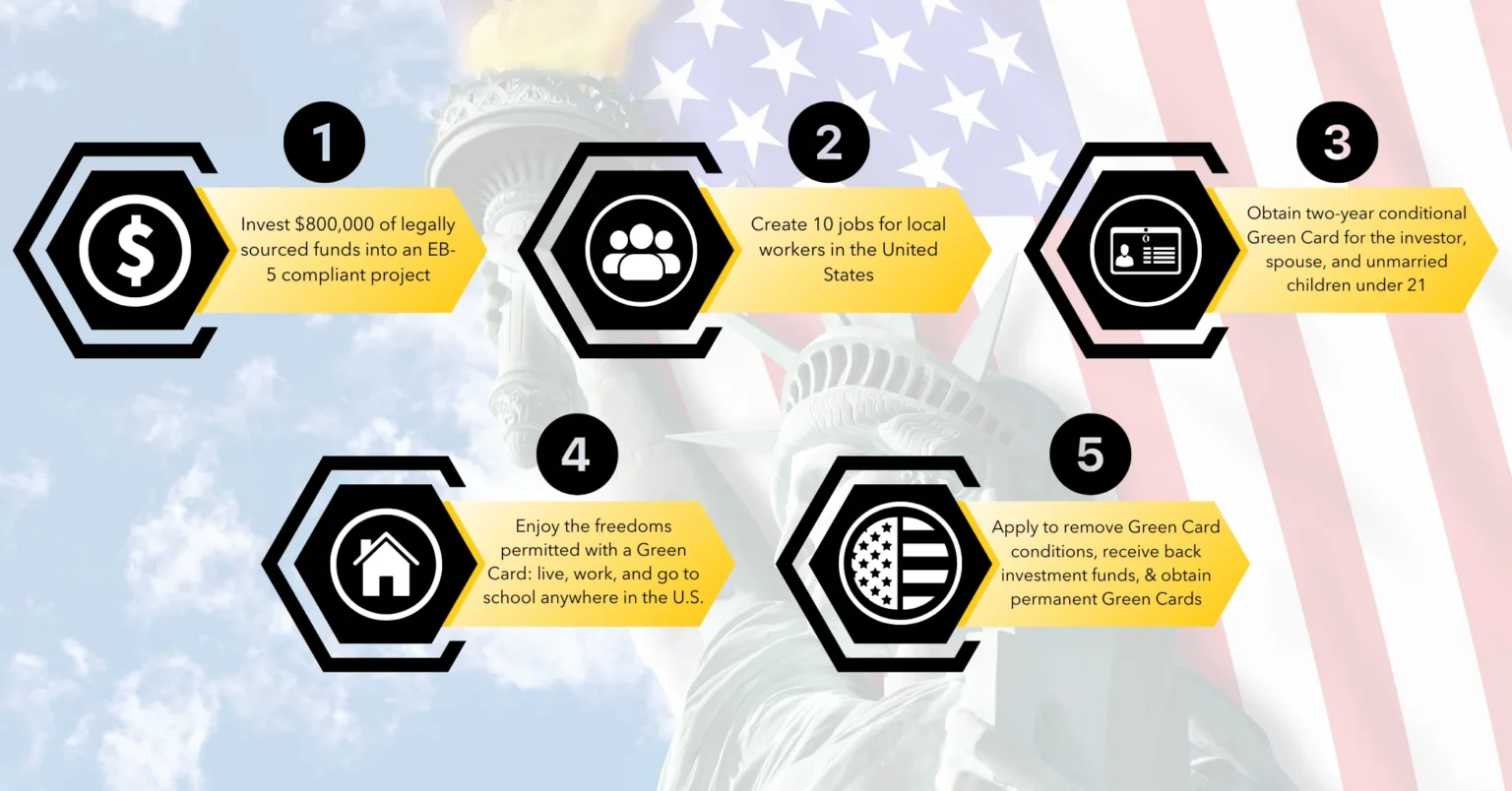

For foreign nationals seeking a secure pathway to residency in the United States, the EB-5 Immigrant Investor Program stands out as one of the most direct and effective options. Established by Congress in 1990 to stimulate the U.S. economy, this program offers a unique opportunity: by investing capital in American businesses that create jobs, investors and their immediate families can obtain permanent Green Cards.

At the heart of this process are EB5 investment projects. These are the tangible developments—ranging from luxury hotels to rural infrastructure—where your capital goes to work. Choosing the right project is not just a financial decision; it is the cornerstone of your immigration journey. Whether you are motivated by the desire to provide education opportunities for your children or to expand your business footprint in North America, understanding the landscape of these projects is essential. This guide will walk you through the types of projects available, the benefits they offer, and how to navigate the selection process safely.

What Are EB5 Investment Projects?

EB5 investment projects are commercial enterprises that qualify for the EB-5 Immigrant Investor Program. To understand their role, you must first grasp the program’s core purpose: job creation and capital EB5 Investment Projects. When you invest in an EB-5 project, you are essentially funding a new commercial enterprise (NCE) that must prove it will benefit the U.S. economy.

The most critical requirement for these projects is job creation. For every single investor, the project must create or preserve at least 10 full-time jobs for qualifying U.S. workers within two years. This is a strict metric; if the jobs aren’t created, the permanent Green Card is not issued.

There are also financial thresholds to consider. The standard minimum EB5 Investment Projects amount is $1,050,000. However, the vast majority of investors choose projects located in Targeted Employment Areas (TEAs). A TEA is defined as either a rural area or an area experiencing high unemployment (at least 150% of the national average). If a project is located within a TEA, the minimum investment requirement drops significantly to $800,000. This incentive drives capital toward areas that need it most, creating a win-win scenario for local communities and foreign investors alike.

Types of EB5 Investment Projects

The landscape of EB-5 investments is diverse, offering options that cater to different risk appetites and immigration goals. Generally, these projects fall into three main categories: Rural, Urban, and Infrastructure.

Rural EB5 Projects

Rural projects have gained significant attention following the EB-5 Reform and Integrity Act of 2022. These projects are located outside metropolitan statistical areas and cities with populations over 20,000. The primary advantage here is priority processing. The USCIS expedites petitions for rural investments, potentially shaving months or even years off the waiting time. Furthermore, 20% of all EB-5 visas are “set aside” specifically for rural investors, which is a massive benefit for nationals from countries with visa backlogs, such as China or India. Examples often include master-planned residential communities like Bay Creek or large-scale agricultural developments.

Urban EB5 Projects

Urban projects are typically located in high-unemployment areas within cities. These are often the most visible EB5 investment projects, involving large-scale real estate developments like hotels, mixed-use residential towers, or office buildings. While they don’t always offer the same priority processing speed as rural projects, they are popular due to their location in established markets with potentially lower market risk. Projects like the Terra Ceia Multifamily development or Spring Haven are classic examples where developers utilize EB-5 capital to fund construction in bustling economic zones that still meet high-unemployment criteria.

Infrastructure Projects

A newer and smaller category involves infrastructure projects administered by a government entity. These might include railways, utilities, or public works. While less common than real estate, they play a vital role in regional economic development and offer their own set of visa set-asides (2%).

How to Choose the Right EB5 Investment Project

Selecting the right project is the most critical step in your EB-5 journey. It requires a balance of immigration safety (getting the Green Card) and financial safety (getting your money back).

Financial Security and Viability: You must evaluate the project’s capital stack. How much developer equity is in the deal? If a developer has “skin in the game,” they are more motivated to succeed. Look for projects where EB-5 funds are a smaller portion of the total cost, or where the loan is senior secured, meaning EB-5 investors are first in line to be repaid in case of default.

USCIS Approval and Job Cushion: Investigate the project’s immigration stats. Has the project received I-956F approval? This form indicates that USCIS has reviewed the project’s documentation and deemed it compliant. Additionally, look for a high “job cushion.” If a project needs to create 100 jobs for 10 investors but is projected to create 150, that 50% cushion protects your Green Card even if the project underperforms slightly.

Regional Center Track Record: Most investors work through Regional Centers—entities designated by USCIS to sponsor projects. You should scrutinize their history. Have they successfully repaid past investors? Do they have a history of project denials? A reputable Regional Center with a track record of 100% project approvals offers peace of mind that is invaluable in this high-stakes process.

Benefits of Investing in EB5 Projects

The primary allure is the immigration benefit. Once approved, you, your spouse, and your unmarried children under 21 all receive Green Cards.

Beyond residency, there is immense freedom. Unlike other visas, EB-5 investors can live, work, and retire anywhere in the U.S. For those who already hold an investor visa in Ajman, the transition to a U.S. Green Card represents the ultimate step in global business mobility, allowing for seamless travel and expanded market acces

This status grants immense freedom. Unlike H-1B holders tied to a specific employer or L-1 holders tied to a specific company, EB-5 investors can live, work, and retire anywhere in the United States. You can live in Florida while your investment project is in Colorado. Your children can attend U.S. public schools and qualify for in-state tuition at universities, often saving thousands of dollars compared to international student rates.

Beyond immigration, there is the potential for financial return. While EB-5 investments are “at risk” by law (meaning no guarantees are allowed), many projects offer an annual return on investment. Furthermore, successful projects return the original capital principal after the investment term, typically 5 to 7 years. This means the actual “cost” of the Green Card is often just the opportunity cost of the capital plus administrative and legal fees.

Challenges and Risks in EB5 Investment Projects

Despite the benefits, the EB-5 path is not without hurdles. The most significant challenge is often navigating the complex web of immigration laws and financial regulations. The “at risk” requirement means that it is possible to lose some or all of your investment if the business fails. This is why due diligence is non-negotiable.

Project Delays and Failures: Construction projects are inherently risky. Delays in zoning, funding, or construction can jeopardize job creation timelines. If the required jobs are not created within the statutory timeframe, investors risk losing their immigration benefits even if the project eventually succeeds financially.

Policy and Retrogression: Immigration policies can shift. While the Integrity Act of 2022 brought stability, visa retrogression (backlogs) remains a risk for applicants from high-demand countries. If the annual visa cap is reached, investors may face additional waiting periods before they can enter the U.S., although set-aside visas for rural and infrastructure projects currently help mitigate this issue.

Mitigating the Risks: To protect yourself, always partner with reputable experts. Use an independent immigration attorney who represents you, not the project. work with experienced Regional Centers that provide transparent reporting and have a history of navigating USCIS audits successfully.

Future Trends in EB5 Investment Projects

The EB-5 industry is currently in a phase of renewal and optimization following the legislative updates of 2022. We are seeing a distinct shift toward rural projects. The incentive of priority processing is a powerful motivator, driving more capital into America’s heartland. Developers are responding by structuring high-quality deals in rural TEAs that were previously overlooked.

Another emerging trend is stricter compliance and transparency. The new integrity measures require Regional Centers to undergo more rigorous auditing and pay into an integrity fund. This naturally weeds out bad actors and increases the overall quality of available projects. We can also expect to see more sophisticated financial structures, with investors demanding higher returns and better security positions now that the minimum investment threshold has increased to $800,000.

FAQs About EB5 Investment Projects

What is the minimum investment required for EB5 projects?

For projects located in Targeted Employment Areas (TEAs)—which include rural areas and high-unemployment urban areas—the minimum investment is $800,000. For all other projects, the minimum is $1,050,000.

How long does the EB5 process take?

Processing times vary significantly. Historically, it could take several years. However, rural projects currently benefit from priority processing, which can result in approvals in less than 12 months. Standard cases typically take between 24 to 48 months, depending on the applicant’s country of origin and visa availability.

Can family members be included in the EB5 application?

Yes. A single investment covers the primary investor, their spouse, and all unmarried children under the age of 21.

What industries are best for EB5 investments?

Real estate development (hotels, residential complexes, mixed-use) remains the most popular industry due to its ability to generate high job counts through construction expenditure. However, hospitality, healthcare facilities, and infrastructure projects are also viable and common sectors.

Are there risks involved in EB5 projects?

Yes. By law, the investment capital must be “at risk,” meaning no guarantees of return or repayment can be made. Risks include potential loss of capital and denial of the immigration petition if the project fails to meet job creation requirements.

What is the role of regional centers in EB5 projects?

Regional Centers are USCIS-designated organizations that pool investor capital to fund large projects. They handle the administrative burden of tracking job creation and compliance, making it easier for investors to meet the program’s strict requirements compared to managing a direct investment themselves.

Conclusion

Investing in the EB-5 program is a significant life decision that bridges the gap between financial investment and personal freedom. By carefully selecting high-quality EB5 investment projects, you are not only securing a potential financial return but also opening doors to a new future in the United States for your family.

The landscape is competitive and complex, but with the right due diligence and expert guidance, the path to a U.S. Green Card is clearer than ever. Do not navigate this alone—consult with experienced immigration attorneys and financial advisors to ensure your American dream is built on a solid foundation.