If you’re living in the UK and you have bad credit, you may be wondering how you can go about getting a loan. It can be tough to find a lender who will work with you if your credit score is low, but it’s not impossible. There are a few things you can do to improve your chances of being approved for a loan.First, start by checking your credit score. You can get a free credit report from companies like Experian, Equifax, and Call Credit. If your credit score is low, work on improving it before you apply for a loan. You can improve your credit score by paying your bills on time, keeping your credit utilization low, and avoiding late payments.

If you can’t get your credit score up to a good level, you may want to consider applying for a secured loan. A secured loan is a loan that is backed by collateral, such as your home or car. This means that if you can’t make your payments, the lender can take the collateral to repay the loan.

Another option is to apply for a loan with a co-signer. A co-signer is a person who agrees to be responsible for the loan if you can’t make the payments. This can help you get approved for a loan even if your credit score is low.

Finally, be prepared to provide proof of your income and your expenses. Lenders want to know that you can afford to repay the loan, so they may ask for proof of your income and your expenses. Make sure you have all of the documentation ready to go so you can speed up the application process.

If you’re struggling to get a poor credit loan, don’t give up. There are a few things you can do to improve your chances of being approved. Start by checking your credit score and working on improving it if it’s low. You may also want to try applying for a loan with a co-signer. And be prepared to provide proof of your income and expenses. With a little bit of effort, you should be able to get the money you need.

Types of Loan for Bad Credit

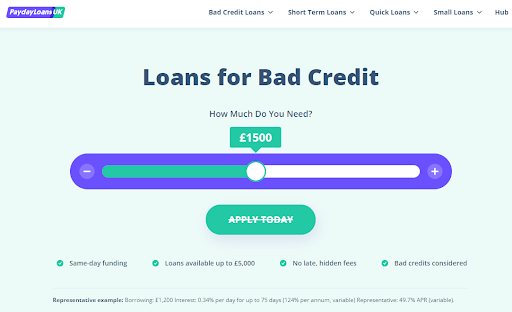

When you have bad credit, it can be tough to get a loan. The good news is that there are a variety of loan options available, even if you have poor credit. Here are four types of loans that may be available to you:1. secured loans: Secured loans are loans that are backed by collateral, such as your home or car. This type of loan is a good option if you have bad credit because it is a high-risk loan. Lenders from PaydayLoansUK are more likely to approve a secured loan than an unsecured loan.

- installment loans: Installment loans are loans that are paid back over time in fixed monthly payments. This type of loan is a good option if you need a large sum of money and you have bad credit.

- payday loans: Payday loans are short-term loans that are typically due on your next payday. This type of loan is a good option if you need money quickly and you have bad credit.

- personal loans: Personal loans are loans that can be used for a variety of purposes, such as debt consolidation, home improvement, or medical expenses. This type of loan is a good option if you need a large sum of money and you have bad credit.

No matter what type of loan you choose, be sure to read the terms and conditions carefully before you sign anything.

What To Consider When Taking Out A Loan With Bad Credit

If you’re considering taking out a loan with bad credit, there are a few things you need to keep in mind. lenders on PaydayLoansUK are usually more cautious when it comes to approving loans for people with bad credit, so you may have to pay a higher interest rate or put down a larger down payment. Here are a few other things to keep in mind when seeking a loan with bad credit: -Your credit score is not the only factor that lenders look at when considering a loan. They will also examine your debt-to-income ratio, your credit history, and your ability to make monthly payments.

-It’s important to be honest with the lender about your credit history. If you have a history of missed payments or defaults, be upfront about it. This will help the lender determine whether or not you are a risky borrower.

-Be prepared to provide evidence of your income and your assets. This will help the lender feel more confident that you will be able to repay the loan.

-Be prepared to provide a cosigner. If you can’t get a loan on your own, you may be able to get one with a cosigner. This is someone who agrees to be responsible for the loan if you can’t repay it.

If you’re thinking about taking out a loan with bad credit, it’s important to do your homework and compare offers from different lenders. By taking the time to do your research, you can find a loan that works for you.

How To Improve Your Credit Score

Your credit score is one of the most important numbers in your life. A high credit score can help you get a loan for a house or a car, and a low credit score can make it difficult to get a loan at all.So how can you improve your credit score? Here are a few tips:

- Check your credit report. Make sure there are no errors on your report, and dispute any errors that you find.

- Pay your bills on time. This is the most important thing you can do to improve your credit score.

- Keep your credit card balances low. Don’t borrow more money than you can afford to pay back.

- Don’t apply for too many loans or credit cards. This can hurt your credit score.

- Use a credit monitoring service. This can help you stay on top of your credit score and make sure there are no errors on your report.

If you follow these tips, you can improve your credit score and get on the path to a better financial future.

Do Bad Credit Loans Require A Credit Check?

When you’re in need of quick cash, a bad credit loan may seem like the answer. But do you need a credit check to get one?In most cases, bad credit loans will require a credit check. This is because lenders want to be sure that you’re able to repay the loan before they approve you. However, there are some lenders who don’t require a credit check.

If you have bad credit, it’s important to shop around for a loan that fits your needs. There are many lenders who are willing to work with borrowers who have a less-than-perfect credit history.

If you’re looking for a bad credit loan, be sure to do your research. Compare interest rates and terms from different lenders. And be sure to read the fine print before you sign anything.